Finance 101 for Hardware Startups. Check out our mini-MBA primer for hardware entrepreneurs that may not come from a finance background. Do you have plan to manage working capital? How does that plan hold up if sales growth exceed projections? Learn more about how to manage these topics and more at Manufacturing Hub.

Understanding Your Company’s Finances

Let’s say that you have a brilliant idea for a hardware-based product. Maybe you’ve even got a functioning prototype that is already impressing early customers. This means that you’re pretty much set for the future, right? Think again – what you need now are the skills to manage your money and keep your business running smoothly. If you’re a first-time hardware entrepreneur, understanding your startup’s finances can be tedious and frustrating if you lack a background in business.

That’s why we’re here to give you a crash course in finance so you can make informed decisions about managing your company’s money. We’ll provide an introduction to cost centers, profit margins, and working capital. Not to mention, we’ll explain what it means to specifically finance a hardware startup, because – spoiler alert – it’s very different than financing a software startup.

Decoding Financial Jargon

Let’s define the basic terms that you’ll need to know when managing your startup’s finances. We’ll start with pricing: the retail price refers to the target price of sale to the ultimate user of your product. On the other hand, the wholesale price refers to the price at which your company sells your product. In general, the retail price must be four times the cost that it takes to make the product in order to support all other selling and delivery expenses. For manufacturing companies, the retail price needs to be even higher (think: 10x instead of 4x). It’s critical to confirm cost structures in the specific case of your company, taking into account how your distribution network impacts your pricing structure.

There are three main expenses that you need to understand: 1) cost of goods sold (COGS), 2) operating expenses (OpEx), and 3) interest and taxes (I&T). COGS is made up of the expenses that you attribute directly to production of your product (i.e. raw materials, processing, assembly, factory, facility, equipment, etc.). Conversely, OpEx includes expenses that are not directly related to your product (i.e. administrative payroll and office space). Finally, I&T encompasses Federal, state, local, and payroll taxes, in addition to expenses related to business loan interest.

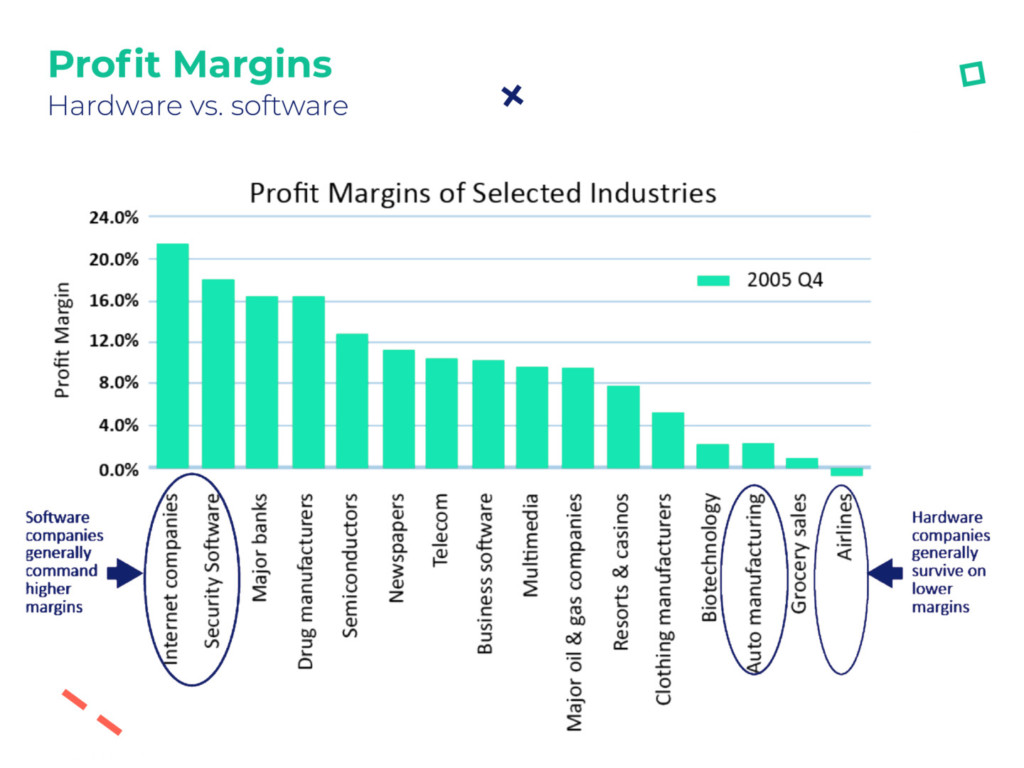

Hopefully, your business will also be making money. Revenue refers to the total income received through the sale of your products and services – this is your “top line”. When you subtract COGS, OpEx, and I&T from revenue, you’ll get net profit (also known as your “bottom line”). To calculate your net profit margin, divide your total revenue by your net profit. Keep in mind that your profit margins can vary greatly based on your particular business model and industry. For instance, large drug manufacturers may have a margin of 20%, while a small company selling printed circuit boards may only have a margin of 1.7%.

Lastly, you need to understand working capital, which takes into account product-related assets and liabilities. It represents your business’ operating liquidity and is calculated by subtracting current liabilities from current assets. A related term, working capital cycle, refers to the time it takes to turn product assets and liabilities into cash. Naturally, the faster you can do this, the better.

Finances for Hardware vs. Software

Some might claim that “finance is finance”, and in a certain sense, they are right. Nonetheless, this assumption underestimates how much financing activities and metrics differ from one business to another. When it comes to comparing hardware and software companies in particular, there are a number of key differences to keep in mind with regard to money management.

First, hardware startups require a heavy capital expense whereas software startups generally do not. If you’re a hardware entrepreneur, it not only costs a lot of money to get started, it also costs a lot of money to keep things going. Moreover, you oftentimes don’t see a return on your investment (ROI) for many years. In general, software startups tend to see money come back to them sooner, making for a quicker ROI. Profit margins are a contributing factor to ROI, with hardware companies seeing lower margins than software companies, as illustrated below:

While software companies are able to scale more easily, hardware companies face barriers as they grow. For many of these reasons, hardware-based endeavors are considered to be higher risk than software ventures. Nonetheless, this doesn’t mean that you won’t be successful in hardware – it just means you have to approach your finances a little differently.

Getting to Know Your Cost Centers

Hardware companies manage to survive and thrive on low profit margins by strategically managing their money and business operations. With low margins, they know that every expense impacts their bottom line. They keep operations lean, ensure scaling investments are in line with product-demand projections, and avoid overborrowing or underselling their product. They make capital expenditures on facilities, equipment, and tooling in a timely manner, and ensure that their growth investments are appropriately staged to reduce the cost of securing money (i.e. loan interest). Finally, they are intimately familiar with the flow of money in and out of their companies.

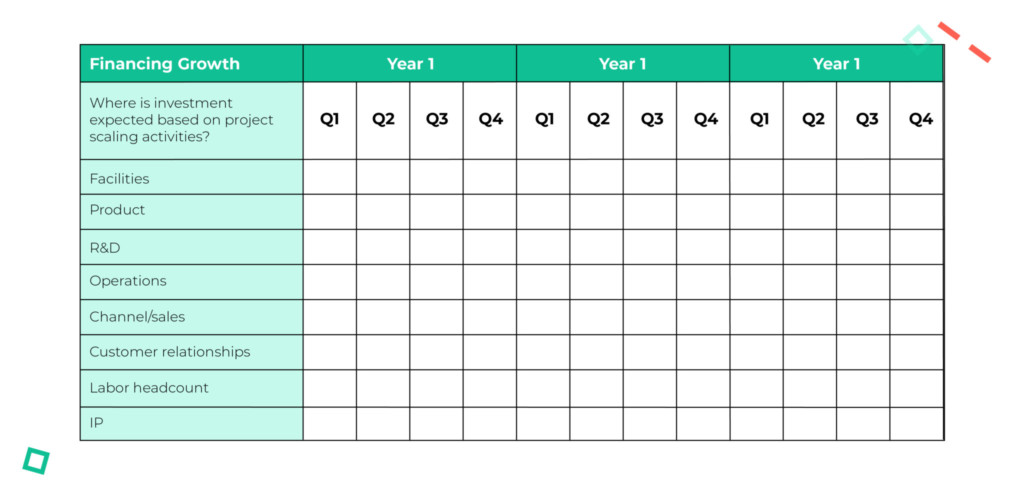

This outbound flow of expenses happens in what we call cost centers. To better understand where your money is going, review your business model and make a checklist of what you’re financing now. Existing costs could be anything from capital equipment, tooling, and materials, to product inventory, distribution, and human capital. Next, identify overarching cost centers that house your existing and future costs. These typically include: facilities, product, R&D, operations, sales, customer relationships, labor headcount, and intellectual property. Then, project what expenses will be flowing through each cost center as you scale in the coming years, as illustrated in the figure below:

Survival Depends on Working Capital

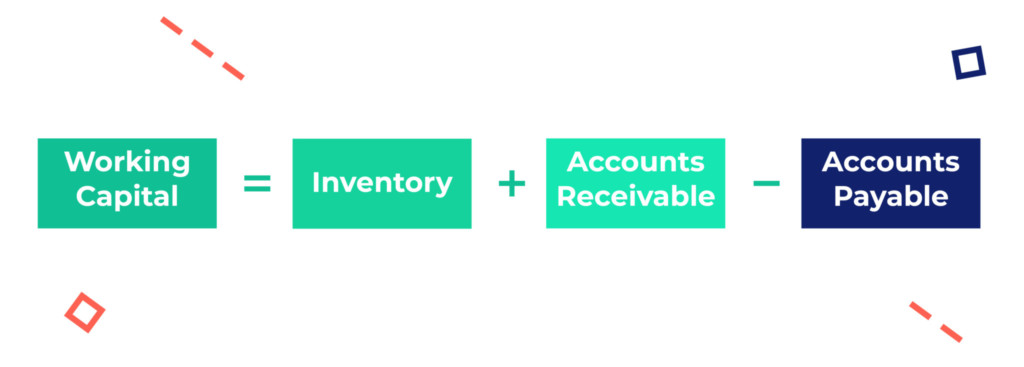

Now that you understand how your money flows through cost centers in the long run, you need to know what it all means for survival in the short run. All businesses need working capital to fund investments in inventory and accounts receivable to allow normal day-to-day trading to continue. What exactly goes into working capital? It’s the inventory you have on hand, plus the money that you’ll be paid (accounts receivable), minus the money that you owe (accounts payable), as shown below:

While this formula is helpful and applies to any business, keep in mind that for a manufacturer, inventory is a bit more complicated. Manufacturing inventory is made up of three components: 1) raw materials, 2) work in progress (WIP), and 3) finished goods. Manufacturers have to purchase and hold an inventory of raw materials, issue the materials into WIP, and apply direct labor and overhead to convert the raw materials into finished goods. As such, their working capital equation looks like this:

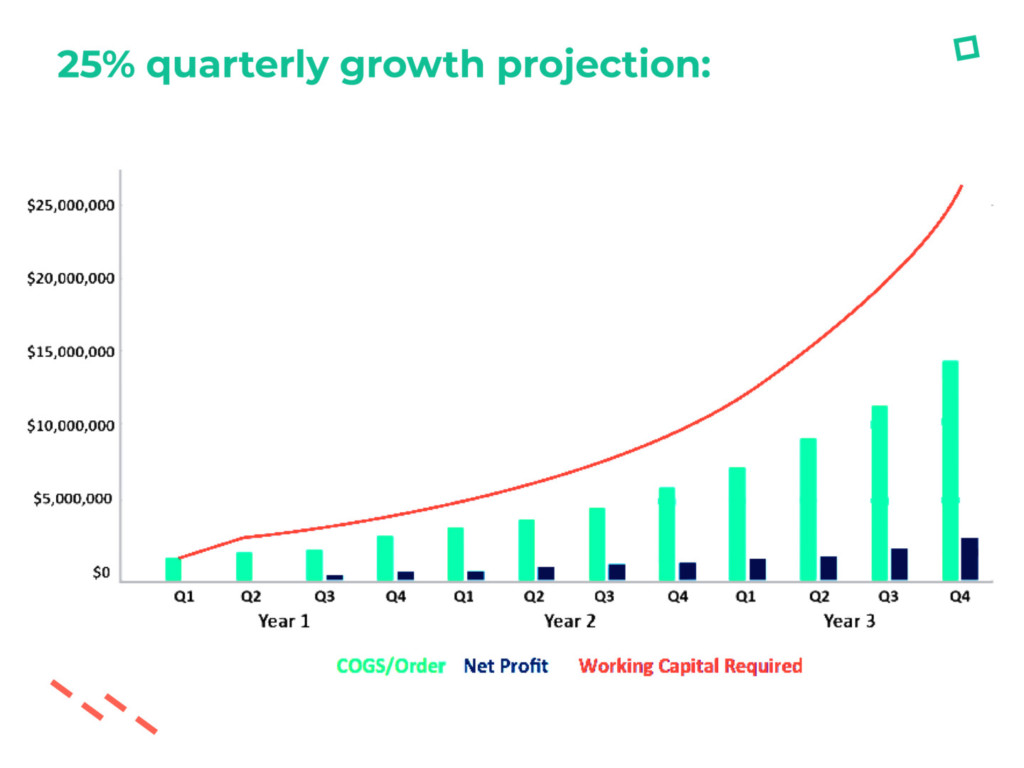

It’s also important to understand what scaling means for working capital. As an example, let’s say that you’re a toy manufacturing startup with the operating assumptions outlined below. How would your working capital requirements change over time as you grow at the target of 25% per period?

ADL Ventures offers help with raising funds for working capital

As a team of entrepreneurs, ADL has a proven track record in successfully launching and scaling startups. We understand the unique needs of early-stage companies and what it takes to break through barriers to find a first customer.

Operating Assumptions

| COGS Unit | 5 |

|---|---|

| Retail Price | 20 |

| Wholesale Price | 15 |

| Net Profit Margin | 8% |

| Production Time | 2 mo |

| Delivery Time | 1 mo |

| Payment Time | 3 mo |

| Growth Target Per Period | 25% |

| Initial Order Qty | 250,000 |

As you can see from the figures above, you’ll need an increasingly high amount of working capital to maintain day-to-day business operations. Yet, note that in this example, the COGS unit price remains constant at five dollars. Generally, as you increase production volume, this cost will decrease (typically a 5-10% reduction year-on-year). The COGS unit price depends on lots of things – volume, commodity pricing, supply and demand, and capital investments needed to scale. As such, companies should regularly perform COGS assessments to ensure accuracy of working capital.

Making Your Working Capital Work

Achieving high amounts of working capital can initially be daunting, but don’t be discouraged. You can minimize the amount of working capital required in a number of different ways. Try reducing working capital cycle time, or reducing delivery time, customer payment time, and production time. Decrease inventory carrying costs, arrange for longer-term contracts with suppliers, or spread out payments to suppliers over a longer period of time. By gaining operating efficiencies and running as leanly as possible, you’ll be able to make your working capital work for your business.

Want to learn more about the financial side of the house? Sign up to receive additional information sent straight to your inbox so you can start managing your company’s money like a pro.