The sunk cost fallacy has sunk many hardware start-ups. Understand the various cost categories that should inform your financial models and startup business decisions.

Product Cost Counts

Even if you have an amazing, ground-breaking idea for a product, that’s simply not enough. Cool ideas just remain cool ideas unless you can bring them to life in a realistic way. In other words, is your idea feasible? Some hardware startups don’t fully think through all of the costs associated with running their businesses and producing their products ahead of time. They jump right in, pleased at the fact that they are earning revenue, only to be blindsided by failure later as a result of cash flow issues. To avoid these kinds of missteps, you need to know all of the costs associated with the design and manufacturing of your product like the back of your hand.

However, some costs are more obvious than others. That’s why we’re here to walk you through four different cost categories that should be a part of any financial model you build. These categories will ultimately support you in calculating your cost of goods sold (COGS), a key cost metric for any hardware-based company.

Considering Market Feasibility

One of the reasons that understanding your costs is so important is because they contribute to your market feasibility assessment. Evaluating your costs before you launch your product allows you to identify potential risks and adjust your business model, pricing, or product design accordingly. For instance, reducing product costs before launch enables you to introduce your product at a more appropriate price for your customers. Accurately assessing your product costs also leads to more sustainable margins – a critical component given that hardware-based companies typically have much lower margins in the first place. Analyzing how your product design affects manufacturing costs may cause you to decrease the complexity of the final version to save money during production. Furthermore, understanding the costs associated with how products are manufactured will help inform and optimize your scaling strategy.

As such, a market feasibility assessment typically includes the following topics: industry and customer needs assessment, current market analysis, competitive landscape analysis, anticipated future market potential, potential buyers or sources of revenue, sales projections, opportunity vs. risk assessment, and a thorough analysis of your costs and margins. In this post, we’ll focus on the last topic: cost.

Fixed vs. Variable Costs

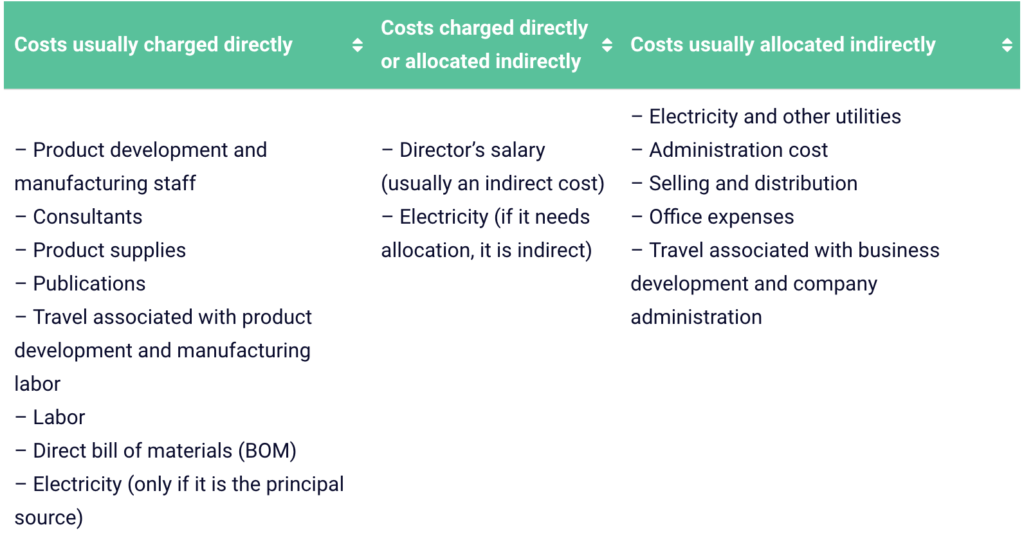

The first two cost categories you need to know are fixed costs and variable costs. Fixed costs refer to costs that do not change based on the business’ level of output – you’ll need to pay for these expenses independent of any business activities. Examples of fixed costs would be things like salaries, leases, insurance, or utilities. On the other hand, variable costs refer to costs that vary with your level of output. These are things like product materials, delivery, or shipping. The more product you make, the more your variable costs increase. You can calculate your unit cost by dividing your total variable cost by volume; this articulates how much it costs to produce one additional unit. Take a look at the graphic below for more examples of fixed and variable costs (as well as some costs that fall in between!).

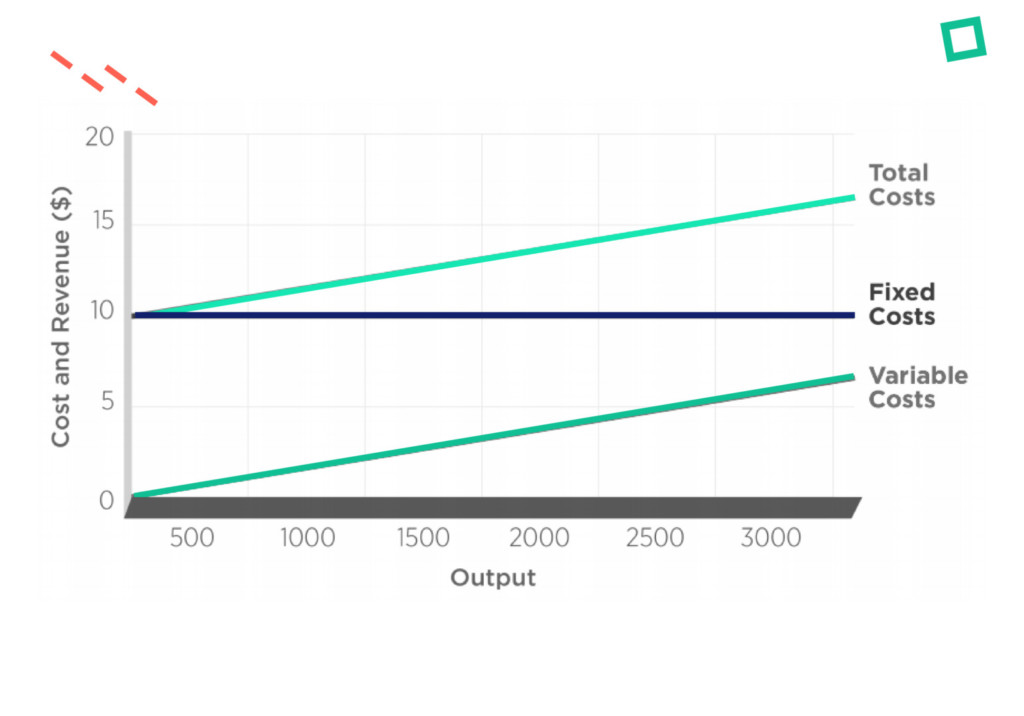

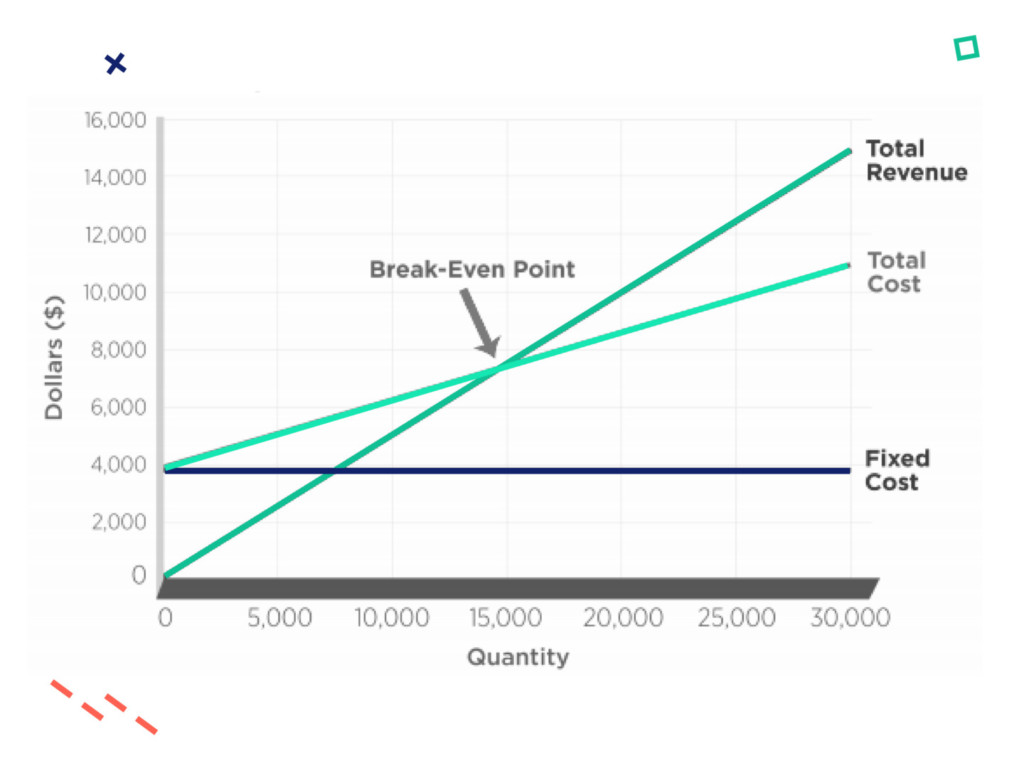

When you combine your business’ fixed and variable costs, you’ll come up with your total cost. A business’ total cost is the total amount spent by the firm on producing a given level of output. The graph below illustrates how each type of cost changes as output increases.

As an entrepreneur, there’s no doubt that you’ve heard the term “breakeven” used at some point. As illustrated in the graph below, the breakeven point represents the sales amount in either unit (quantity) or revenue (sales) terms that is required to cover total costs. As such, the total profit at the breakeven point is zero. It’s worth noting that by keeping your overhead (or fixed costs) low, you’ll be able to achieve your breakeven point with much lower sales and actually start to be profitable! Click here to download a breakeven analysis template from Pathway Lending that you can use for your own business.

Direct vs. Indirect Costs

The third and fourth cost categories that you need to understand are direct and indirect costs. Direct costs are directly attributable to your product (i.e. materials, labor, equipment, etc.). In manufacturing or other non-construction industries, the portion of operating costs that is directly assignable to a specific product or process is a direct cost. In contrast, indirect costs are not directly attributable to a product (but they are typically allocated to the product). For manufacturing businesses, costs not directly assignable to the end product or process are considered to be indirect. You can think of indirect costs as being for activities or services that benefit more than one product (i.e. rent, management, insurance, taxes, maintenance, etc.). Sometimes, costs are allocated – this is a type of expense that is clearly associated with, and therefore assigned to, a certain business process, project, or department. You can allocate costs in different ways, like allocating based on square feet or percentage of hours usage. Review the table below for additional examples of direct and indirect costs.

Understanding your indirect costs is important because it allows you to calculate your overhead cost, or your ongoing expense of operating your business. By calculating what’s called your overhead percentage, you can tell how much your business spends on overhead and how much it spends on making a product. To calculate this, divide your indirect costs by your direct costs. For example, let’s say you have $16,000 in indirect costs and $48,000 in direct costs. That means your overhead percentage is 35%. In other words, your business spends 35% of its money on legal fees, administrative staff, rent, and so on, for every product that it produces. As you might have guessed, low overhead is a good thing! The lower your overhead, the larger your profit.

How to Calculate Cost of Goods Sold

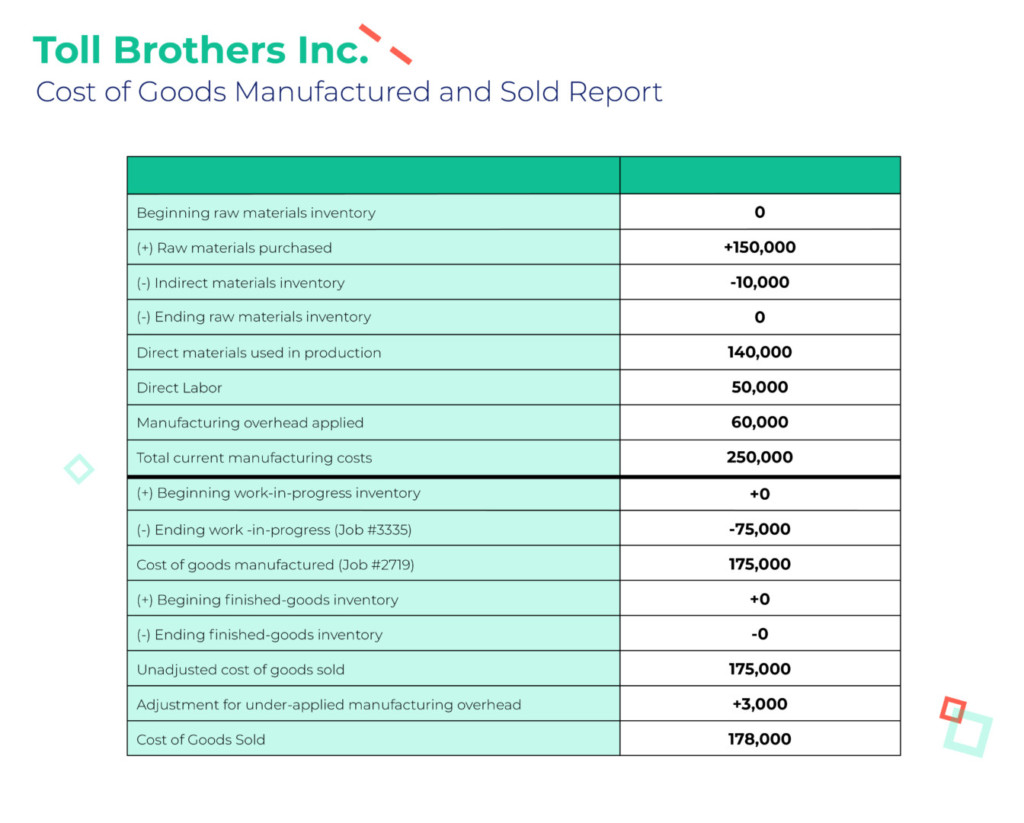

Your cost of goods sold (COGS) encompasses a lot. So, how can you make sure that you’ve accounted for everything that goes into it? It’s helpful to start with a basic formula for COGS, as shown below. You take the finished goods that you have in inventory and add in the cost of goods that you manufactured in order to get the amount of finished goods available for sale. Then subtract the amount of your finished goods inventory to see what you sold, which provides you with your COGS.

The formula for COGS can also be expressed as the cost of goods manufactured plus or minus the change in finished goods inventory. If your finished goods available for sale (also known as inventory) decreased, then the amount of the decrease is added to the cost of goods manufactured. However, if the finished goods inventory increased, then the amount of this increase is deducted from the cost of goods manufactured. It can be helpful to think about the costs that are incurred as the process flows from end to end, starting with your raw materials inventory. Take a look at the table below to see how different costs categories are applied and how inventory levels change throughout the production process, ultimately resulting in your COGS amount. Click here to download an Excel version of this COGS calculator so you can crunch the numbers for your own business.

Getting Savvy on Your Expenses

From fixed and variable costs to direct and indirect costs, it can seem like your expenses are endless. Fear not: the more informed you are on the costs associated with running your business, the easier it is to identify opportunities for improvement. Is there a cheaper raw material you could use to lower excessive variable costs? Is your high overhead pushing your breakeven point back too far? By dialing into individual costs, you uncover all the levers you can pull to improve your company’s profitability.

Just now digging into financial modeling and need some help? Join our community of passionate hardware entrepreneurs and get the support that you need sent straight to your inbox.