Appropriate financing mechanisms for your hardware startup vary by growth stage. Learn more about when a convertible note – AKA “debt wanting to be equity” – is appropriate vs. traditional stock vs. preferred stock vs. newer vehicles such as SAFE.

Financing Your Company’s Growth

As a hardware entrepreneur, you’ve probably had to secure funding at some point to help get your business off of the ground. In fact, most startups excel at early-stage funding efforts to launch the company and develop viable prototypes of their products. However, the next stage of development requires heavy lifting from a capital standpoint – oftentimes, this means getting creative about financing growth. Unfortunately, this is where a lot of startups tend to lose their way.

Many hardware entrepreneurs aren’t aware of the wide breadth of financing options available to them over the life of their business. They make the mistake of limiting their growth-related financing options to venture capital. They spend too much time trying to finance continuous technology development instead of financing the growth of currently viable products. They underestimate the magnitude of the investment needed for scaling up a manufacturing operation. And perhaps most common, they are inconsistent in aligning their financial needs with their commercialization timeline.

You don’t want to make those same mistakes. A new perspective on financing strategies for hardware-based companies can help you avoid delays in time-to-market and pitfalls like losing the support of existing investors. We’re here to shed light on all the financing cards that you don’t even know you hold in your hand – along with how and when you should play them.

ADL Ventures offers help with financing startups

As a team of entrepreneurs, ADL has a proven track record in successfully launching and scaling startups. We understand the unique needs of early-stage companies and what it takes to break through barriers to find a first customer.

Ten-Thousand Foot View of Financing Options

As you assess your options, first ask yourself, “What exactly am I trying to finance?” If it turns out you need to pay for R&D efforts, then your financing options include the following: grants, loans, business plan competitions, accelerators, angel investors, venture capital, strategic partners, and corporate ventures. On the other hand, if you need to pay for product manufacturing, your financing options include: sales (always your number one option!), debt financing, venture capital, corporate ventures, private equity, strategic partners, licensing and royalties, pre-orders, crowdfunding, or even an IPO.

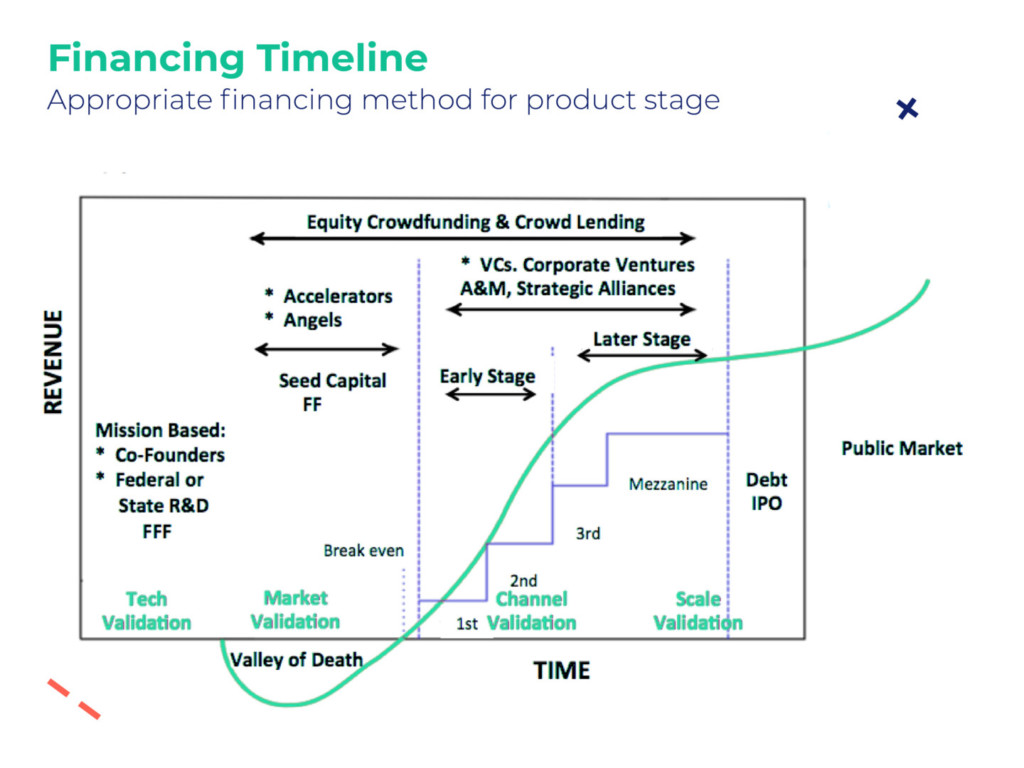

There is no shortage of financing pathways available to you. Each option has benefits and drawbacks depending on your particular business model and where you are with regard to growth and development. Indeed, you should allow the growth stage of your company be the guiding force in the selection of the appropriate financing mechanism(s). Refer to the timeline graphic below that illustrates optimal financing methods based on the product stage.

Major Vehicles for Scale Financing

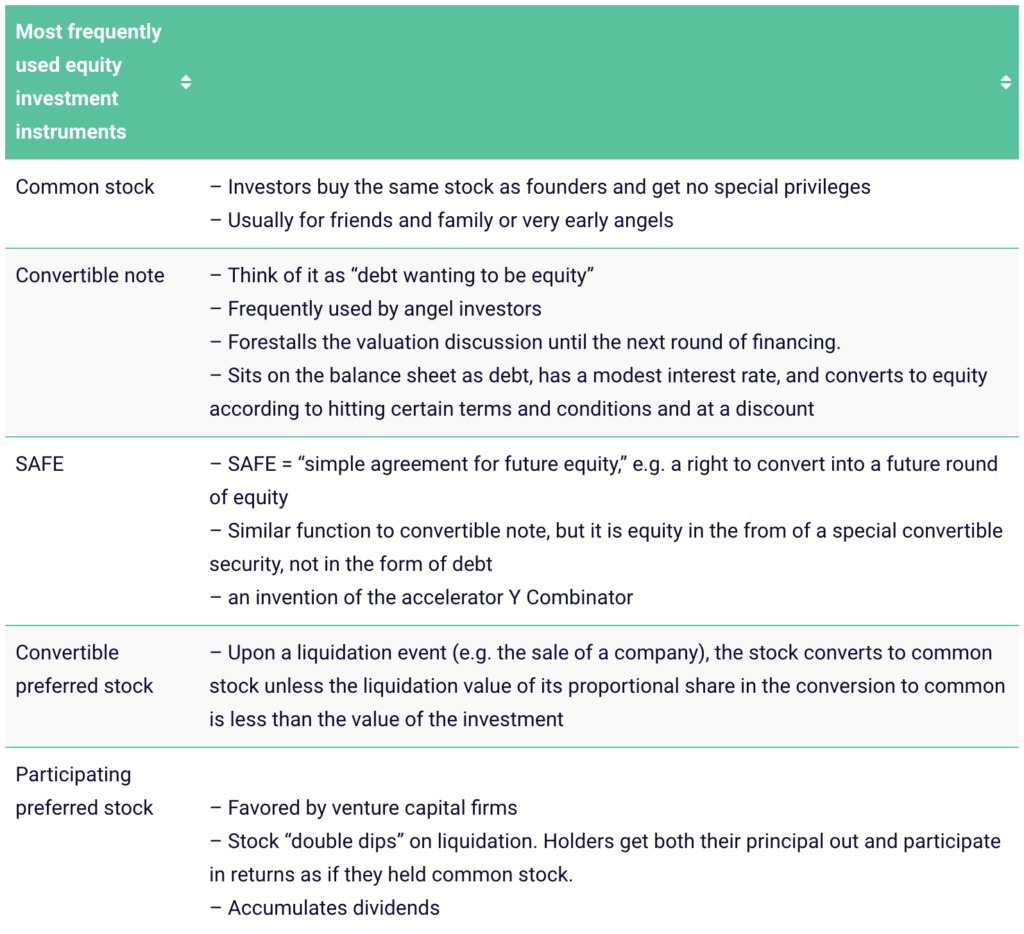

It’s important that you familiarize yourself with the financial vehicles you can tap into across the different growth stages of your startup. Here’s a high-level overview of the main ones, along with links to additional resources where you can access more information. If you need a quick refresher on the different investment and scale financing instruments that are used before you dive into the vehicles themselves, take a moment to review the table below.

Federal, State, and Local Funding

Federal funding exists to support technology advancements in the United States, thereby ensuring that our nation has industry-leading technology. This type of funding is executed through grants and loans from sources like the Department of Energy (DOE) Energy Efficiency & Renewable Energy (EERE), the DOE Vehicle Technologies Office (VTO), or the Advanced Research Projects Agency-Energy (ARPA-E). For state and local funding, the mission is to create jobs and invest in a particular region to spur economic development. Like Federal funding, this is done through grants and loans from state economic development corporations (EDCs), county or city EDCs, and other incubators.

Accelerators and Business Plan Competitions

When it comes to accelerators, missions can vary – although more often than not they are economically-driven. Their goal is to grow early-stage businesses with typical investments of $20,000-$100,000 in exchange for up to ten percent of the company. Accelerators are usually technology-specific and supported by industry, offering funding via equity stake or convertible notes. Check out accelerators such as Cleantech Open, TechStars, or Make in LA for more information.

The goal of business plan competitions is to give awards to the most promising companies. Generally region or network-specific, these grants are anywhere from $5,000-$50,0000. Refer to the TechCrunch Hardware Battlefield or the Zahn Innovation Center Kylie Hardware Awards as examples.

Incubators and Philanthropic Organizations

Incubators typically offer business support services, dedicating themselves primarily to early-stage companies. Oftentimes this means that they provide physical office space or various shared business services. However, they usually don’t engage in financial investment (although they may have equity in companies they support). Check out Clean Energy Trust in Chicago or Austin Technology Incubator in Texas as examples, or do some digging on Incubatenergy Network and Energy Nexus.

You can also receive grants from a variety of philanthropic organizations, whose primary goal is to solve a specific problem or help a particular region. Take a look at the Kresge Foundation, New Economy Initiative, or the PRIME Coalition for examples of these kinds of organizations.

Crowdfunding

Today, many entrepreneurs see crowdfunding as an alternative to formal angel or venture capital funding. There are two high-level types of crowdfunding: first, there is pre-sales funding (like kickstarter funding). This is specifically designed for consumer products companies, as opposed to industrial product offerings. The second type is equity crowdfunding, which to date has been of limited value to high-growth potential startups. The 2012 JOBS Act opened the door to a wider range of equity funding options from individual investors, not just accredited, wealthy individuals. Crowdfunding through approved internet platforms allows you to raise up to one million dollars in a twelve-month period from non-accredited investors. Proceed with caution, however: lots of small investors can be distracting!

It’s important to understand the U.S. Securities and Exchange Commission (SEC) rules (like Rule 506b) when dealing with crowdfunding. Better yet, consult a lawyer with lots of SEC regulation experience!

Angel Investors

Angels are high net-worth individuals or groups that invest personal money to get a return. They seek a 1-10x return from their investments and typically invest $50,000-$250,000 in exchange for 10%-20% of the company. More often than not, angel investors are former entrepreneurs who have successfully grown and sold companies. They tend to focus on local entrepreneurs and invest in areas of personal interest or experience. Ideally, you’d like to find an angel that can bring more than money to the table (think: expertise, strategy, connections). Learn more about angel investors from sources like AngelList, PropelX, SeedInvest, and Angel Capital Association.

Venture Capital

Simply stated, venture capitalists are money managers that manage investor stakeholders’ money. They usually invest in the $500,000-$10,000,000 range for Series A-C and often require a majority stake in the company. These investors care about your company having significant market potential and a 10x portfolio return to their stakeholders in roughly seven years. They’ll expect you to have a risk mitigation strategy, proof that there is more demand for your product than what your current resources can support, along with promising scalability and time to market. Do your due diligence when it comes to venture capital firms – they typically require a board presence and decision-making authority. Refer to these investor forums for more information: NREL, Clean Energy Trust, and Cleantech Group.

Corporate Strategic Investment

This financing vehicle refers to tech-scouting units of large corporations that are interested in new technology that supports their product development and corporate strategy. They usually invest in later-stage companies (Series B+), don’t require a majority share, and don’t necessarily need a board presence. Their goal is to improve their internal processes, gain efficiencies, secure a competitive technological advantage, or differentiate their products. However, this is usually a lengthy process that requires multiple layers of approval. See NineSigma, NextChallenge, and CB Insights for reference.

Getting Smart on Financing

Overall, take time to consider your options when it comes to financing. Remember, your first priority should always be to finance your growth through sales whenever possible. Your second priority should be to finance growth through projected sales that allow you to secure low-cost debt or loans. Needless to say, only take the money that you need. Avoid racking up debt and keep operations as lean as possible. And before you enter into a financing agreement, do your homework to get smart on what it means for your business today, tomorrow, and down the line.

Want more information on financing your business? Join our community of passionate hardware entrepreneurs and get guidance on growth financing sent straight to your inbox.