While an in-housing strategy can help protect valuable IP, most hardware startups cannot make the capital investment required to build prototypes in-house. Don’t take the decision lightly: a single decision could impact your entire value chain and trickle down to your bottom line. Check out our 3-step framework for making build vs. buy decisions.

Managing the Moving Pieces

It takes a lot to get a business up and running. You’re managing product design, operations, manufacturing, distribution, marketing, finance…and the list continues. For hardware-based companies in particular, scaling your company involves lots of moving pieces. You’re working to launch a tangible product that has to be built and manufactured – something that your software counterparts often don’t understand or appreciate. With so much to manage, at some point in time most hardware startups find themselves facing the classic question: build or buy?

In other words, you need to determine which components you are going to produce in-house (build) and which components you are going to outsource to a third party (buy). Oddly enough, the intuition is often to just “do it yourself”. It seems like that would be cheaper, and you’d certainly have more control over the process…right? This kind of thinking is often misguided and inaccurate for early-stage companies. Chances are, you don’t have the cash on hand or the infrastructure required to handle things in-house. Contrary to what you might think, it can be much more cost-effective to outsource certain components to third parties with specialized expertise. So, how do you determine which components are best to outsource? How do you know what should stay in-house?

3-Step Build vs. Buy Assessment

There are a number of different factors that you should take into account when making a build vs. buy decision. How does it impact your supply chain? What does your bill of materials look like for in-house (captive) manufacturing in comparison to outsource (contract) manufacturing? How do things change with fluctuations in volume? What is everything going to cost? It can seem like there is an endless list of questions to consider. That’s why we’ve broken down the build vs. buy assessment into a simple three-step process – so you can reach an informed decision more quickly.

Step 1: Review Your Business Model

Build or buy decisions can impact all areas of your business. You can’t make these decisions in a silo; consider how they might affect your holistic operation. What’s more, build vs. buy decisions aren’t necessarily limited to manufacturing and distribution – make sure to consider what outsourcing might mean for other functions as well. As such, in this first step, review your overall business model and take inventory of where you are currently. Is anything being outsourced at the moment? If not, are there any business functions that are struggling to execute on their work or have limited bandwidth?

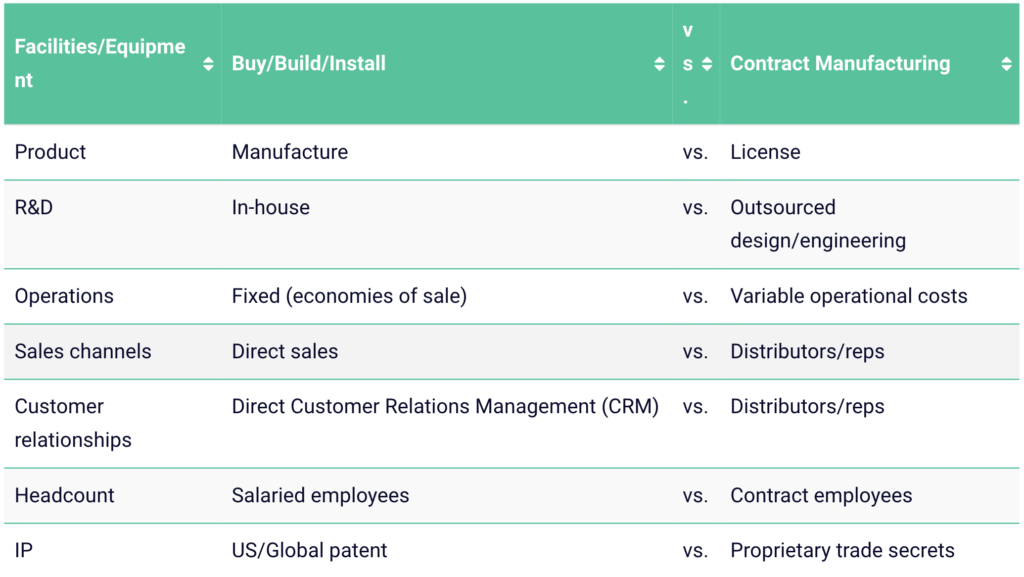

It can be helpful to use a table like the one shown below to ensure that you’re fully thinking through all relevant build vs. buy decisions for your business model. As you consider each one, assess how it would affect the rest of your value chain. It’s also important that you factor in your overall business strategy and core competencies, along with supply chain risk, intellectual property, and production volume changes into this assessment.

Captive Versus Outsource Model Options (Make vs. Buy)

Step 2: Evaluate the Different Risks

Based on the particular functions that you prioritized in the first step, analyze the different kinds of risks associated with outsourcing or keeping certain capabilities in-house. Remember that there is not always a binary “build” or “buy” answer. You can contract one piece of the puzzle and directly handle another, or even outsource something and modify it later in the process. Therefore, make sure that you’re evaluating all relevant scenarios.

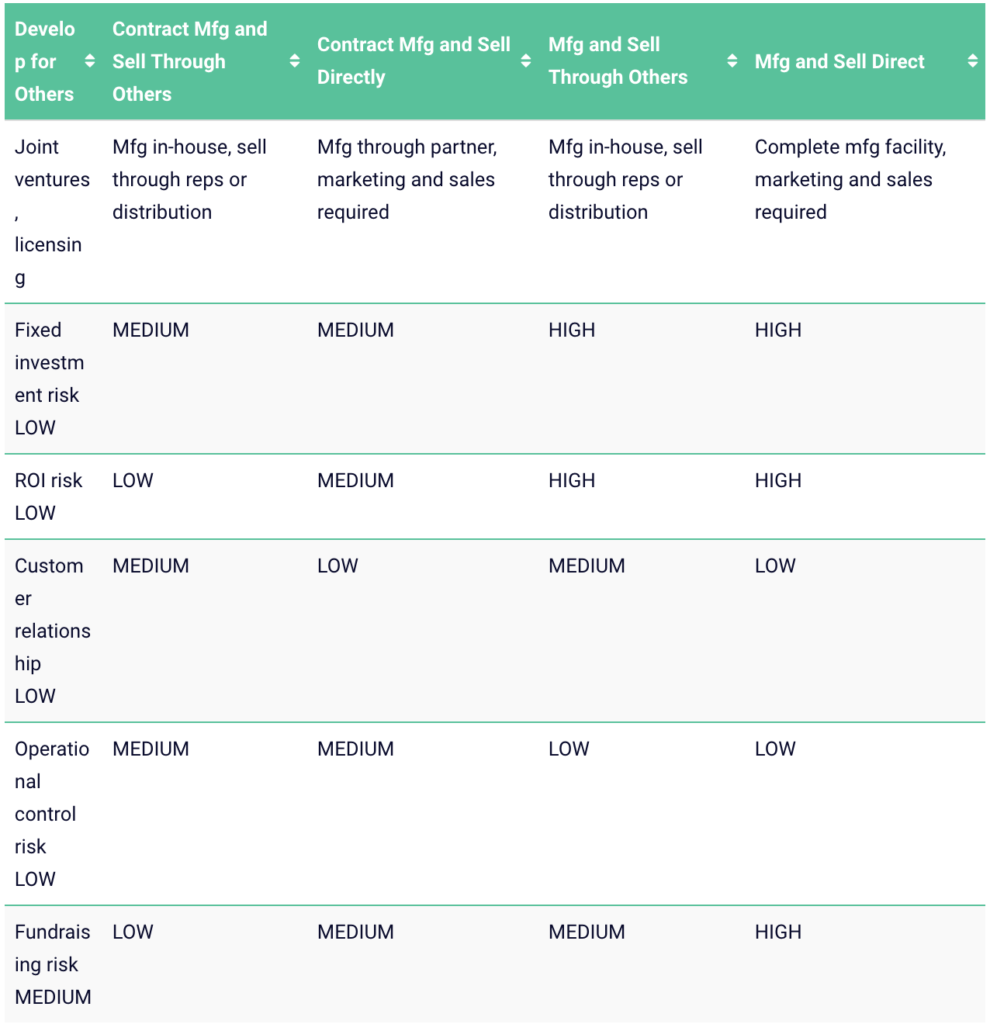

For example, refer to the table below that evaluates different risks associated with captive vs. outsourced manufacturing and distribution. For hardware startups, this is often one of their core build or buy discussions. In this example, you could outsource both manufacturing and distribution, outsource just manufacturing and sell directly, outsource sales and handle manufacturing directly, or keep both manufacturing and sales in-house. With each scenario, assess the risk level with regard to the fixed investment, ROI, customer relationships, operational control, and fundraising. Naturally, it’s generally less desirable to select an option with significant risk (although there could be circumstances in which this is justified). However, keep in mind that as you scale, you can reduce risk across areas like customer relationships, operations, and quality control.

Evaluate the Different Risks

Step 3: Analyze the Financial Impacts

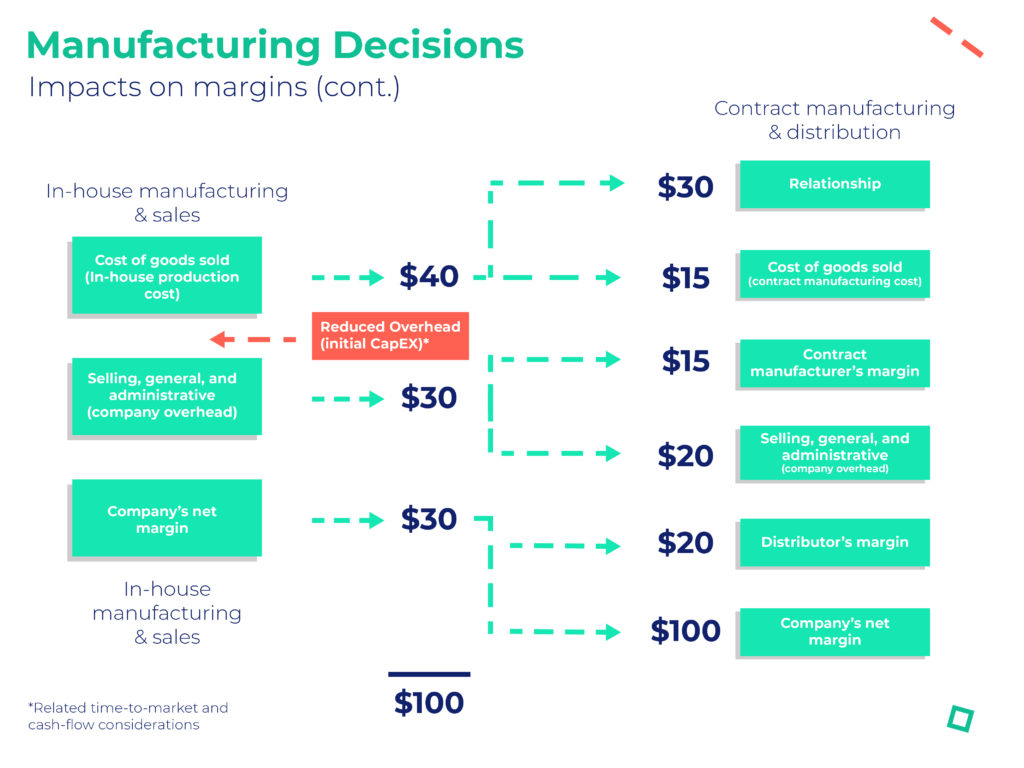

Before moving forward with any build or buy decision, you must understand how it will impact the bottom line. In this step, compare the effects that different decisions have on your financials (while also taking into account the risk from step two). For instance, let’s compare the decision to keep manufacturing and sales in-house with the decision to contract out both capabilities to a third party.

As shown below, first you must identify the variable and fixed costs associated with in-house production. This includes the cost of goods sold (COGS) as well as your selling, general, and administrative (SG&A) costs. Then, identify the COGS and SG&A costs if you were to outsource manufacturing and distribution. Make sure that you factor in contractor margins for both the manufacturer and distributor! It’s critical that you account for this to avoid artificially inflated margins. Then, compare your company’s net margins to determine which decision is ultimately more profitable.

Keep in mind that as you (or your contracted third party) scales production and increases the volume of units produced, you will likely see lower costs as you achieve economies of scale. Be sure to factor that into your longer-term financial analysis to inform your decision.

Adopting a Holistic Mindset

Build or buy discussions are not to be underestimated or taken lightly – a single decision could impact your entire value chain and trickle down to your bottom line. If you’re a hardware startup that’s short on cash, then it’s even more important for you to consider how you’re going to get the biggest bang for your buck. Implementing this three-step process will help your team align and look at build vs. buy decisions from all angles, ultimately reaching an informed decision more efficiently.

Are you in the midst of a build vs. buy decision at your company? Sign up now and we’ll send additional information on strategic supply chain management straight to your inbox